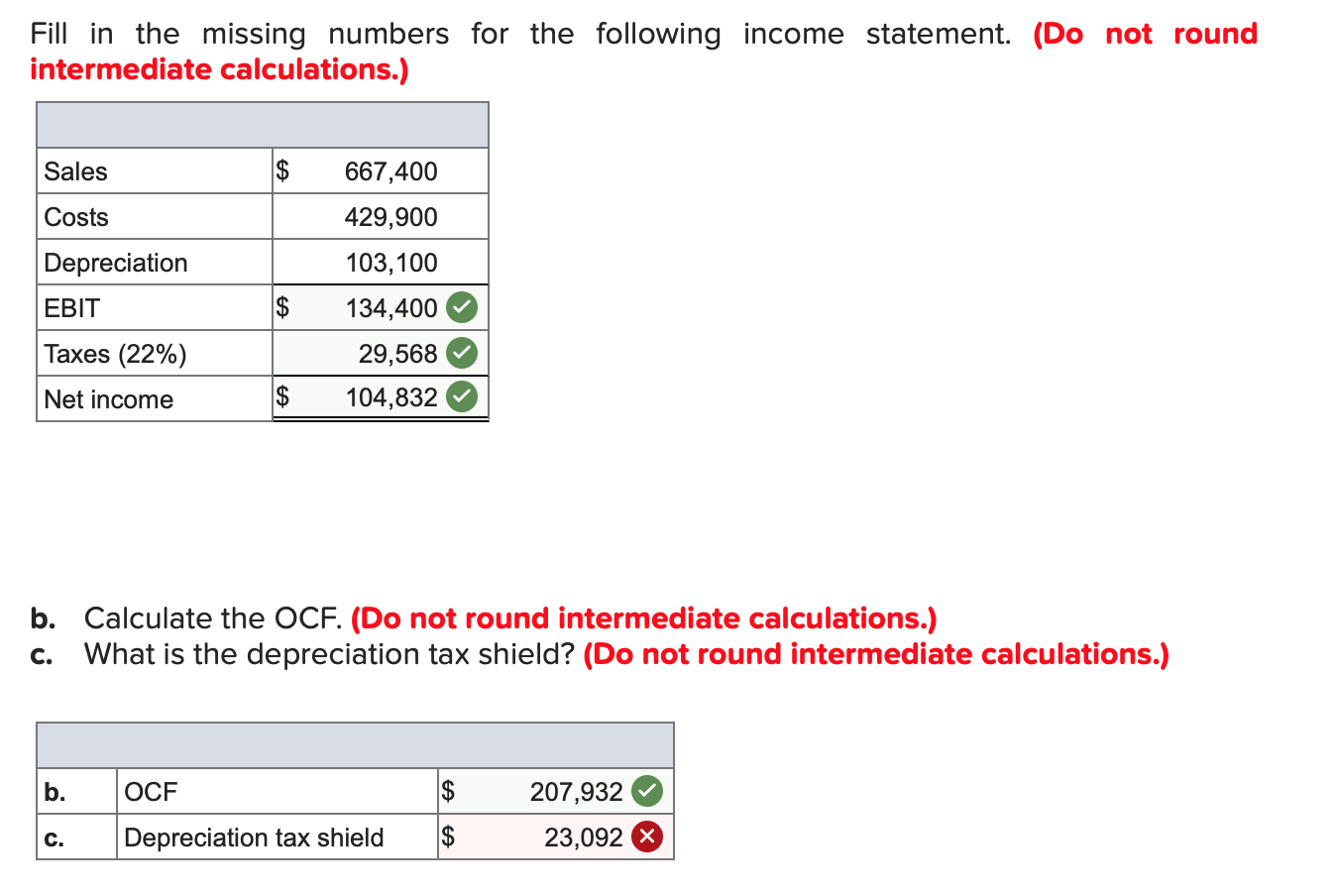

Beyond Depreciation Expense, any tax-deductible expense creates a tax shield. The booked Depreciation Tax shield is under the Straight Line method as per the company act. The net benefit of accelerated depreciation when we compare to the straight-line method is illustrated in the table below. For more detailed information, consider consulting a tax professional or financial advisor. Additionally, governmental tax websites and reputable financial education resources offer guidance on tax planning and strategies.

Tax Shield Formula Explanation Video

The concept of depreciation reflects the diminishing value of assets over time. The Depreciation Tax Shield accounts for this reduction by allowing businesses to deduct depreciation from taxable income, thereby reducing the overall tax burden. Have you ever wondered freshbooks vs quickbooks how depreciation affects how much taxes a business pays? Let’s explore how this important concept can impact a company’s financial planning and tax liability. This small business tool is used to find the tax rate by using interest expenses and depreciation expenses.

- Let’s explore how depreciation can benefit businesses in a simple and engaging way.

- In the final step, the depreciation expense — typically an estimated amount based on historical spending (i.e. a percentage of Capex) and management guidance — is multiplied by the tax rate.

- GAAP accounting, the expense is recorded and spread across multiple periods.

- The amount by which depreciation shields the taxpayer from income taxes is the applicable tax rate, multiplied by the amount of depreciation.

- A tax deduction allows a company to increase its Net Operating Profit After Tax and helps it grow faster.

How to Value a Business…Made Simple – Learn Finance ASAP #2

The Depreciation Tax Shield Calculator assists in determining the financial benefit derived from the depreciation of assets, which can be deducted from taxable income. This tool is especially useful for businesses looking to maximize tax efficiency by leveraging asset depreciation. It’s advisable to calculate your tax shield annually, as part of your tax preparation process. However, if your business experiences significant changes in expenses or income, recalculating more frequently can help you adjust your financial planning accordingly. Non-deductible expenses include fines, lobbying expenses, political contributions, and any costs not directly related to business operations.

Purchase Price Allocation in 4 Steps – The Ultimate Guide (

When filing your taxes, ensure you are taking these deductions so that you can save money when tax season arrives. Tax shields allow for taxpayers to make deductions to their taxable income, which reduces their taxable income. The lower the taxable income, the lower the amount of taxes owed to the government, hence, tax savings for the taxpayer. The term “tax shield” references a particular deduction’s ability to shield portions of the taxpayer’s income from taxation.

It is easy to note the difference in the tax amount payable by the business at the end of each year with and without the annual depreciation tax shield. If we add up all the taxes, the amount is substantial, which could be saved if the business had charged depreciation in the income statement. The use of a depreciation tax shield is most applicable in asset-intensive industries, where there are large amounts of fixed assets that can be depreciated. Conversely, a services business may have few (if any) fixed assets, and so will not have a material amount of depreciation to employ as a tax shield. That interest is tax deductible, which is offset against the person’s taxable income. Taxpayers who have paid more in medical expenses than covered by the standard deduction can choose to itemize in order to gain a larger tax shield.

Please be aware, the privacy policy may differ on the third-party website. Adtalem Global Education is not responsible for the security, contents and accuracy of any information provided on the third-party website. Note that the website may still be a third-party website even the format is similar to the Becker.com website. Our mission is to provide useful online tools to evaluate investment and compare different saving strategies. To wrap this up, we hope you now have a much better understanding of the Depreciation Tax Shield Calculation as well as the underlying concept.

In order to qualify, the taxpayer must use itemized deductions on their tax return. The deductible amount may be as high as 60% of the taxpayer’s adjusted gross income, depending on the specific circumstances. In the above example, we see two cases of the same business, one with depreciation and another without it.

This alternative treatment allows for the use of simpler depreciation methods for the preparation of financial statements, which can contribute to a faster closing process. The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction. Similar to the tax shield offered in compensation for medical expenses, charitable giving can also lower a taxpayer’s obligations.

Tax shields vary from country to country, and their benefits depend on the taxpayer’s overall tax rate and cash flows for the given tax year. This small business tool is used to find the depreciation tax shield by using tax rates and depreciation expenses. Businesses can use depreciation to spread out their tax deductions over time and manage their money better. By choosing the right way to depreciate their assets, they can lower their tax bills and have more cash for other things.

The deductible expenses are all the necessary costs you must cover to operate your business. In order to calculate the depreciation tax shield, the first step is to find a company’s depreciation expense. Those tax savings represent the “depreciation tax shield”, which reduces the tax owed by a company for book purposes.